Experienced in using Excel spreadsheets for her bookkeeping needs and created a collection of user-friendly templates designed specifically for small businesses. As a small business owner, there are few tasks that are more important to successfully manage your business than bookkeeping. When selecting a bookkeeping style, business owners have several options. Learn how QuickBooks Live Expert Assisted can help you streamline your bookkeeping and free up time spent on finances. You know what a bookkeeper does and what their day-to-day responsibilities look like. But how do these job duties translate as benefits for your business?

Your financial transactions

For example, if you know your client only has a certain amount of cash on hand, you can be more careful about how it is spent. Learn how to navigate UK & EU VAT rules, avoid common pitfalls, and streamline your accounting. Updating your software ensures that you gain access to the latest features, security updates, and other enhancements.

Reviewing Budget vs. Actuals: Evaluating Financial Performance Against Goals

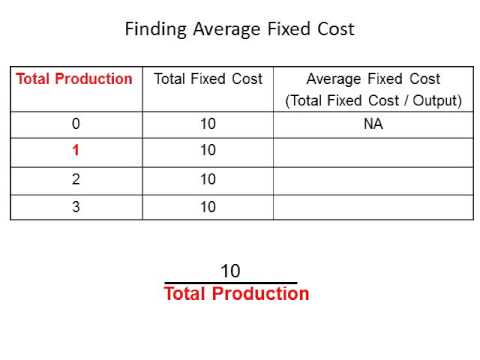

Experience quick and easy bookkeeping with Link My Books by starting your 30-day free trial today. Connect with our team at Link My Books to learn how we can help you achieve accurate, hassle-free bookkeeping. If a worker is making purchases for the business, make sure they communicate it to the person in charge so the transaction can be recorded properly. You may be how to calculate break required to do everything in one business and just a small section in others.

The Essential Bookkeeping Checklist for Small Businesses

To help with producing reports, it is necessary to enter details into an Excel spreadsheet. It allows for calculations and sorting of data and can make figures easier to read. Topical articles and news from top pros and Intuit product experts.

However, a bookkeeper can do cash flow forecasting quarterly, too, if that’s what you need. If, however, your business has a very tight cash flow, you may want to track this daily or weekly. Your cash flow position is what you need to look at when you need to check your business’s profitability over the next months and years. Part of daily bookkeeping tasks is preparing a revenue and expense account.

That’s why it’s crucial to stay on top of bookkeeping tasks for up-to-date snapshots of the health of your business at any given time. If you use accounting software, you should also have that back up to a local drive or the cloud every month. If not, you can ask your bookkeeper to budgeting common terms and definitions create a backup manually. In case of any kind of failure, redoing the books for a month-long period is not exceedingly difficult for a small business.

Bookkeeping Tasks for Small Business

- Our tool integrates seamlessly with your sales channels and accounting platforms, automating the bookkeeping process from start to finish.

- Keeping financial records accurate and up-to-date involves a multitude of tasks.

- The term “bookkeeping” and general ledger are practically inseparable.

- A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate.

- Credit control procedures will need to be put in place and checked each day if invoices require chasing for payment.

Neglecting these updates can sometimes lead to compatibility or security issues. By closely monitoring your cash reserves, you can grow your cash flow more effectively and avoid pitfalls. When you bill clients on time, they are more likely to pay you on time. This is because they remember clearly what product or service you sold them.

Filing paperwork usually is by sales or purchases, then by customer or supplier name and then date. Paying suppliers on time is important, as you do not want to upset a supplier and get your credit cancelled. Payments to suppliers may be either by direct debit, standing order, BACS, bank transfer or cheque. It’s a lot to navigate—and if you want to stay on top what is capital in accounting • debt capital of all your accounting tasks (and stay on top of them at the right time), having a checklist can help. Tracking your clients’ cash position means knowing how much money their company has on hand at any given time and making sure expenses get paid on time. By following these simple tips, your clients’ payroll records will always be accurate and up to date.