Content

And in order to correctly understand where your company stands financially, it’s crucial that you understand and accurately track revenue recognition. Contracts with customers is an area that is often involved when revenue recognition is discussed. With so much to keep tabs on, ensuring accurate revenue recognition practices are implemented is no small feat.

- IAS 18 was reissued in December 1993 and is operative for periods beginning on or after 1 January 1995.

- Variability takes many forms and includes discounts, rebates, customer incentives, refunds, credits, performance bonuses, penalties, contingencies, and price concessions.

- This publication contains general information and is not intended to be comprehensive or to provide legal, tax or other professional advice or services.

A third-party sales agent contract or even a distributor agreement may have elements which might fall under the new revenue recognition standard and hence require a different analysis and internal controls standard. Further, as written contracts are specified in the Ten Hallmarks of an Effective Compliance Program as a key internal control, you can easily see how the lack of such a written agreement can fall into the realm of compliance. Even FCPA enforcement actions are relevant here as one of the well-known bribe-funding tactics is to provide a discount to a customer but not credit the company’s books but instead take the actual discounted amount and give to a corrupt official as a bribe.

Global sustainability standards

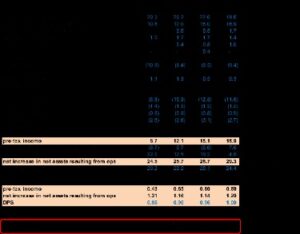

Recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. On May 28, 2014, the FASB and the International Accounting Standards Board issued converged guidance on recognizing revenue in contracts with customers. The new guidance is a major achievement in the Boards’ joint efforts to improve this important area of financial reporting. Let’s look at an example of a company that adopted the standard early to show how a company may report using the full retrospective approach. Figure 1 shows the income statement from 2017 Form 10-K of General Dynamics.

- These costs include commissions, legal fees, marketing costs, and bid and proposal costs.

- There may be data—such as selling expenses—that you need for the new standard but isn’t being captured in your tracking system currently.”

- In other words, it’s money paid in advance, for services or products that are expected to be delivered or performed at some point in the future.

- Contract costs include both the costs of fulfilling a contract and the incremental costs of acquiring a contract.

Companies will need to disclose the nature of the goods and services they provide. Implementation of the new standard will most likely involve departments outside of accounting (i.e., information technology, human resources, and/or sales). Obtain basically all of the remaining benefits (i.e., potential cash flows) from the item. The good or service is neither highly dependent on nor highly interrelated with another good or service promised in the contract. The remainder of this communication is a detail discussion of the key features included in Topic 606 and provides practical insights into its application and impact.

Integrated Reporting

Topic 606 provides implementation guidance to assist entities in evaluating these types of arrangements or contract terms. The goal of the allocation is to attribute an amount to each performance obligation that represents the amount of consideration that the entity expects to be entitled to for fulfilling that performance obligation. Topic 606 not only supersedes or significantly amends almost all of the current guidance provided in Topic 605, but it also affects significantly other subtopics that relate to revenue. For instance, it adds a new Subtopic , Other Assets and Deferred Costs-Contracts with Customers. At times, a contract with a customer may fall, in part, under the scope of Topic 606 and, in part, under the scope of other guidance in the Codification. If so, then an entity must separate the contract into its relevant components and account for each component as appropriate.

Yet there are other tie-ins into compliance which the compliance practitioner needs to understand and prepare for going forward. As a lawyer, that was an approach I was quite comfortable with both from https://kelleysbookkeeping.com/ a learning stand point and communicating to business folks. But now the standard is much more judgment based and when a standard is more judgment based, there can be more room for manipulation.

How is ASC 606 Implemented? The 5 Step Model

This means revenue is recognized in the period when it was earned and realized , rather than when the money was received. Developed by the International Accounting Standards Board and the Financial Accounting Standards Board , ASC 606 went into The New Revenue Recognition Accounting Standard effect in the fiscal year following December 15, 2017. All businesses and organizations engaging in contracts or sales agreements with customers must comply with these standards, whether they’re public or private, for-profit, or nonprofit.

When did IFRS 15 replace IAS 11?

IFRS 15 replaces IAS 11, IAS 18, IFRIC 13, IFRIC 15, IFRIC 18 and SIC-31. IFRS 15 provides a comprehensive framework for recognising revenue from contracts with customers. In September 2015 the Board issued Effective Date of IFRS 15 which deferred the mandatory effective date of IFRS 15 to 1 January 2018.

While the new rule may artificially increase NOPAT for some companies, those changes will also flow through the balance sheet and increase invested capital. The good news for investors is that the distortionary effect of this rule should dissipate after a year. The revenue that was pulled forward into 2018 should be a one-time boost. The commissions that were capitalized appear on the income statement as amortization.

CCOs and compliance practitioners need to consider these issues in the context of compliance internal controls going forward. Under existing GAAP, the required disclosures about revenue are limited and lack cohesion. The current rules require only descriptions of a company’s revenue-related accounting policies and the policies’ effects on revenue, including rights of return, the company’s role as a principal or agent, and customer payments and incentives. Investors and other users of financial statements reported that they found that the disclosure requirements in both GAAP and IFRS were insufficient. A new accounting standard for how entities recognize revenue means big changes for organizations—and not just to their finance departments, but also strategy, IT, HR, sales and marketing, and tax. The new guidance serves as a converged standard from the Financial Accounting Standards Board and the International Accounting Standards Board —one that aligns revenue recognition practices throughout the world.